One of the areas of the market we’ve continued to emphasize, both in our TST weekly Inner Circle market update calls and chat rooms, is the precious metals space – gold in particular – while continuing to closely monitor silver for additional strength:

Gold (GLD) – Daily Chart

Silver (SLV) – Weekly Chart

Looking at silver, on an absolute basis (above) as well as a relative comparison of Silver Futures vs Gold Futures (below), we can see that silver is starting to outperform and the Precious Metals ETF continues to show ongoing strength.

In an environment where gold, silver, and other metal assets are continuing to show increasing demand, correlated Metals & Mining stocks should be doing well, and one name that we especially like is:

Newmont Mining Corp (NEM)

And, if silver is outperforming, then gold should be doing particularly well from a “risk on” perspective.

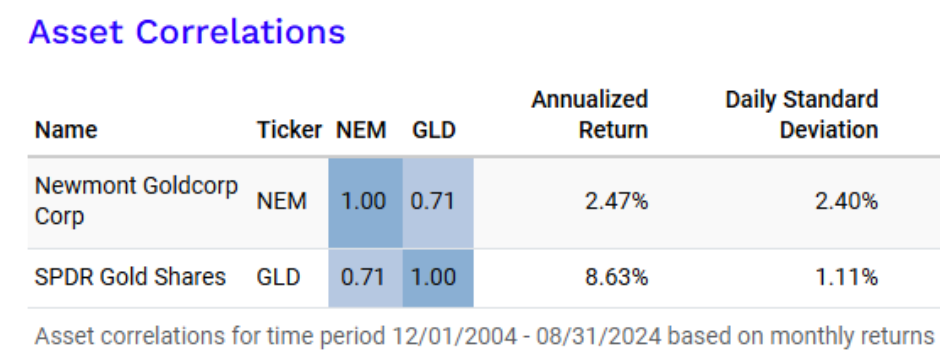

Newmont Mining and gold have a high asset correlation coefficient:

Looking at the Newmont Mining technical chart above, price has recently moved above a “confluence” of technical areas:

- The 200 day moving average

- The 10 day moving average

- The 38.2% Fibonacci retracement level (from the longer term April 2022 – Feb 2024 price retracement),

- Price is above/holding an upward diagonal support line

- The 10/21/50 day moving averages are all pointing upward (bullish).

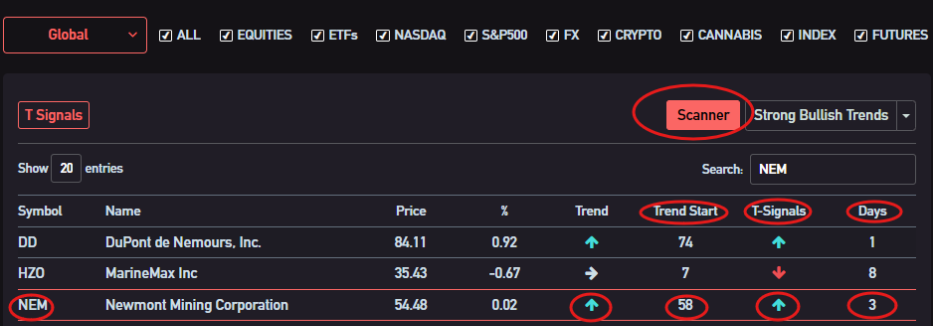

Without needing the deeper technical/chart analysis expertise above, our Inner Circle Market Rover trend/trading algorithm software can help identify trend/trade ideas and specific targets all FOR YOU – so you don’t have to do the “heavy lifting.”

For example, with the click of a few buttons and performing a quick Market Rover scan:

The Market Rover algorithm is showing from NEM:

- The stock has been in an uptrend (green up arrow) for 58 days

- A bullish T-Signal trade idea recently flashing (green up arrow)

- The signal triggered 3 days ago

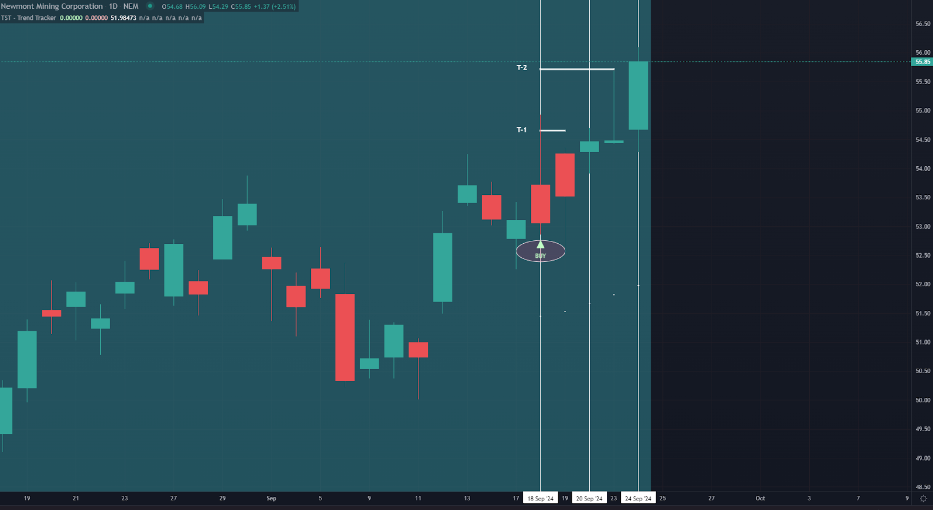

Then, by drilling down and pulling up the Inner Circle member/Market Rover platform chart specifics for NEM

We can further see:

- A buy signal idea occurred on Sept 18th

- Price hit the T-1 Trade Idea target objective on Sept 20th (two days later)

- Price then achieved the T-2 Trade Idea target objective on Sept 24th (Hitting an intra-day high of $56.09 and closing at $55.85)

In addition, we recently highlighted an additional “structured trade” idea, attempting to continue to take advantage of this ongoing green/bullish NEM trend and give us an opportunity to potentially profit should the stock continue to go up, sideways, or even slightly down:

NEM – Bull Put /Credit Spread Trade Idea:

- Selling to open the NEM December 20th 2024 (Monthly Expiration) $50- $45 “bull put” spread for a credit of $0.82

- Selling the 50 put and buying the 45 put for a net $0.82 credit received

- General Closing Guidelines:

- Profit: Buy to close the spread if the total credit received shrinks by 50%

- Stop Loss: Buy to close if the total credit received widens by 50%

All handed to us, thanks to Market Rover. Do you have this powerful tool yet?

Happy Trading!