Stop the chart chasing (Market Video Update)

For the better part of the past 12 months, chart chasing interest rate sensitive tech stocks that are not topical to the current macro environment has not worked…and likely won’t work for some time to come. Becoming more selective is of the essence now, as is lowering one’s return expectations.

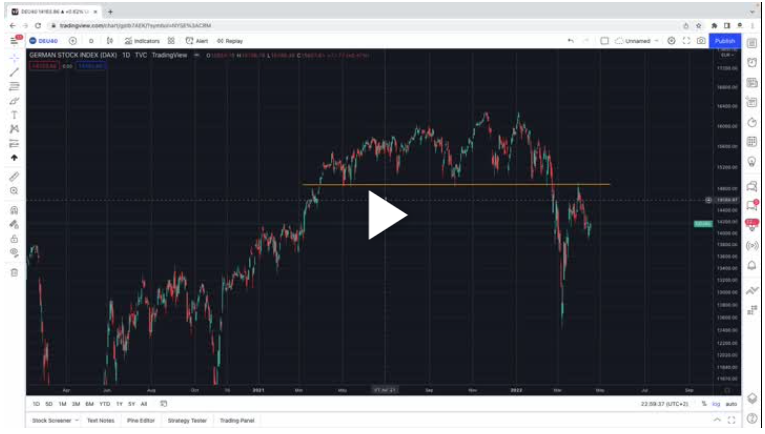

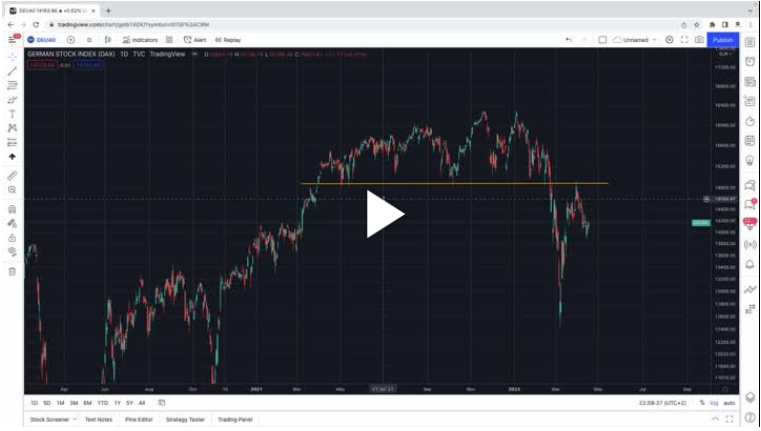

Global Indices are Flashing Bearish Signals (Market Video Update)

One crucial support line has broken in major equity indices around the world. It doesn’t bode well for equities for the time being.

Our Favorite Stock Sector is Still A Buy – Long Energy (Video Market Update)

After an impressive multi-quarter run in both absolute and relative performance by the energy sector, we still think there is lots of upside to be captured: Long Energy Stocks

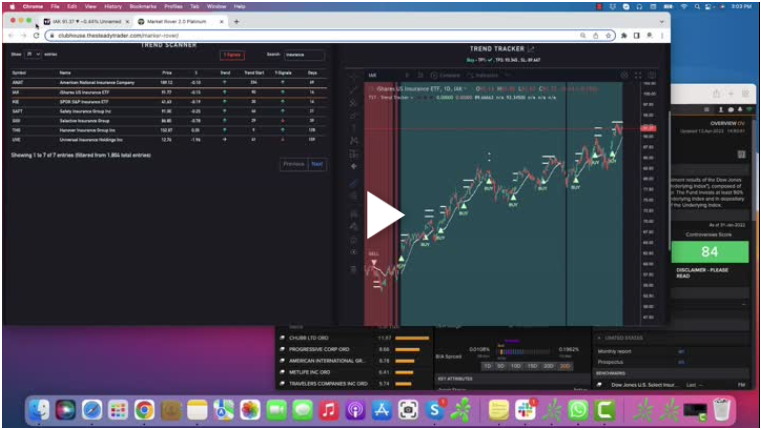

The IAK etf continues to grind higher while stocks struggle (Market Video Update)

Sometimes ‘boring’ stocks or ETFs are the way to go when the rest of the market is a one way street lower. The IAK etf (insurance companies) continues to work for investors and has been stubbornly bullish on our Market Rover since 2020.

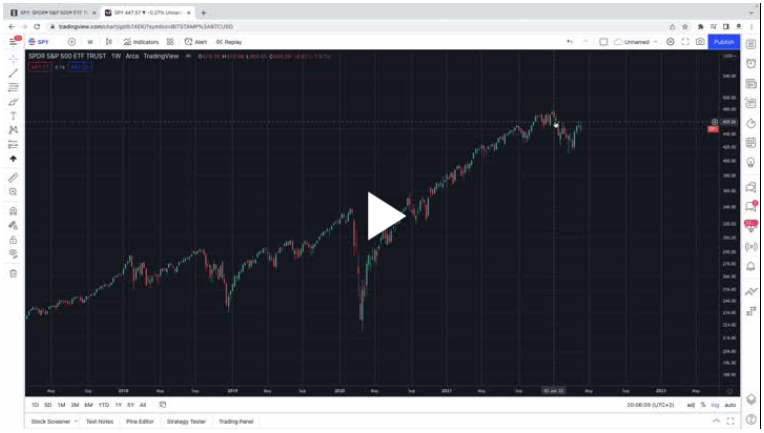

The Fed Wants Lower Stock Prices (Market Video Update)

The Fed wants lower stock prices in order to reign in inflation. While the Fed is likely to ultimately succeed with the ‘lower stock prices’ part, why is the S&P 500 still not correcting meaningfully?

Housing Stocks Could be in Trouble (Market Video Update)

With US 30 year mortgage rates tickling the 5% mark, housing stocks and stocks relating to housing could be further in trouble going forward.

Stocks go up in April? Not so fast (Market Video Update)

April traditionally is a strong month for US stocks, as measured by the S&P 500. This year however the odds of a strong April could be somewhat lower…

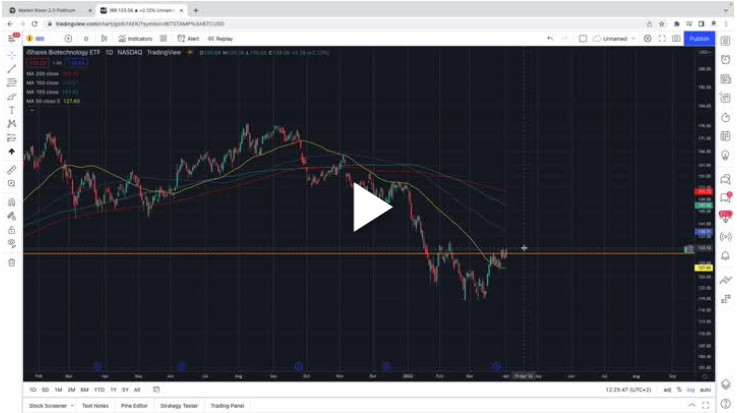

Biotech stocks could be about to do something big (Market Video Update)

After slumping with underperformance, 2022 promises to be more more fertile ground for biotech stocks and biotech ETFs such as IBB and XBI. While the price action is beginning to look better, there is one driving tail wind that could really propel these stock higher in 2022.

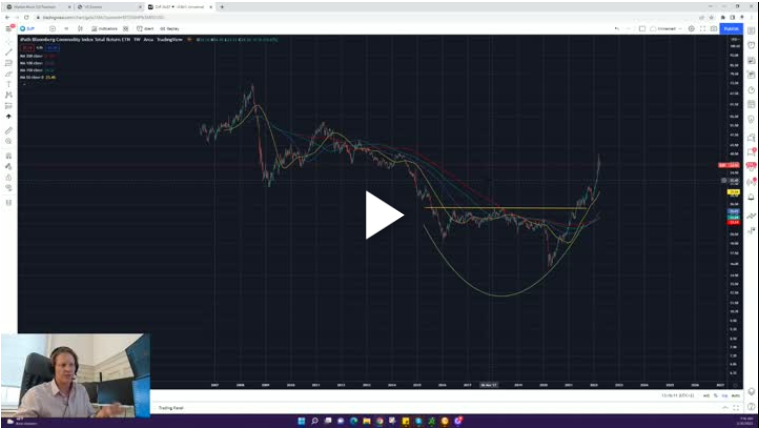

How we are trading the commodity super cycle (Market Video Update)

From our vantage point, commodities are in a new super cycle for time being, i.e a bullish multi-year cycle. However, it is of paramount importance to understand that commodities are volatile and even in a raging commodity bull cycle can still see severe drawdowns along the way. I.e. commodities are more volatile (on average) than […]

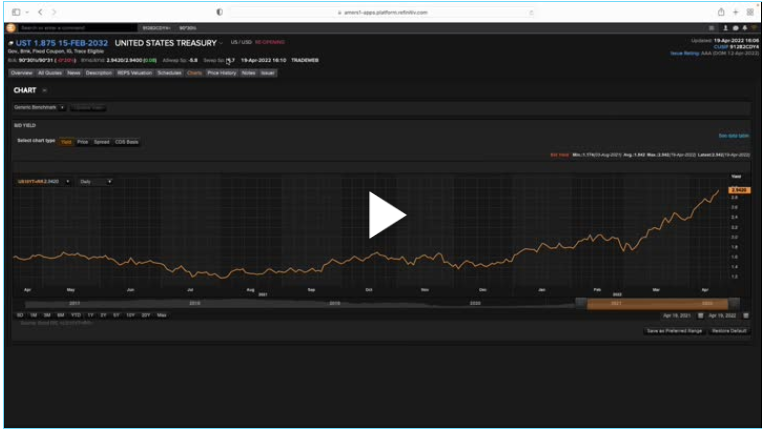

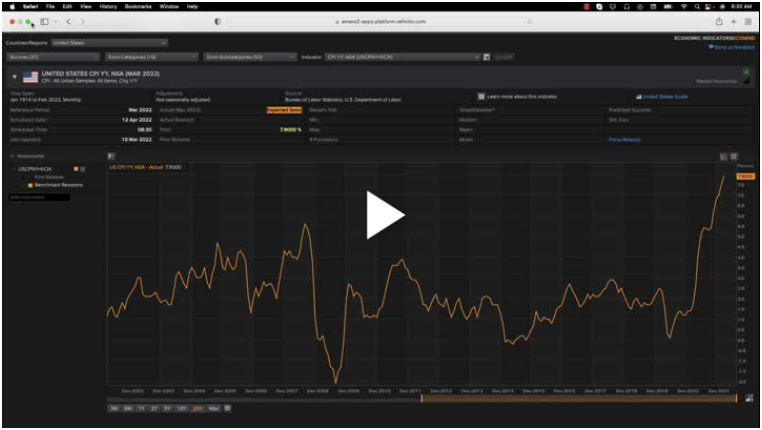

What the yield curve is telling us right now…and what it’s not (Market Video Update)

The yield curve is an interesting and important indicator to watch for broader macro economic read-through. This however should not be confused with nearer term trades, i..e the yield curve is an ill-fitted indicator for something like swing trading.