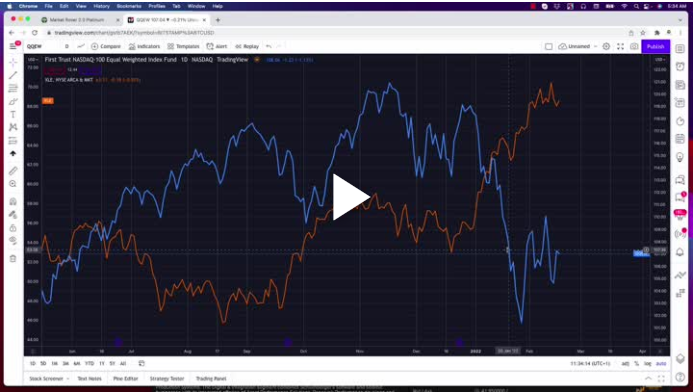

Short tech and long energy is our trade (Market Video Update)

Over the past couple of months the average tech stock is down 20% while energy stocks as a sector are up 25%. That is a giant divergence of performance. One can be better prepared for the correct asset allocation with a straightforward trend following approach.

This is no longer a bull market (Market Video Update)

After almost half of Nasdaq stocks have gotten cut in half over the past 12 months some investors still treat this like a bull market. This is not what bull markets look or act like.

Metals & Mining Stocks on the Rise (Video Market Update) (Market Video Update)

After a dormant period for many metals and mining stocks, they now look primed for a break higher while the broader market remains choppy at best.

Your Portfolio is Highly Correlated to the S&P 500 (Market Video Update)

Most people’s portfolios are so highly correlated to the S&P 500 that unless the S&P goes higher each year, they simply don’t make money. There are ways to break this correlation however.

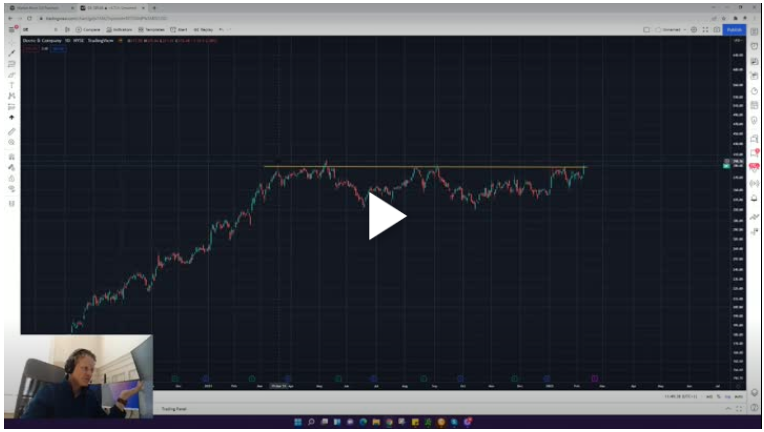

Shares of DE are in a breakout holding pattern (Market Video Update)

The average stock in the S&P 500 is increasingly outperforming the Nasdaq 100. To wit, shares of Deere (DE) are not so coincidentally tracing out a breakout pattern worth paying attention to.

Three ways to play defense in the stock market right now (Market Video Update)

Just like in sports, playing good defense in the stock market is crucial for longer term success. In this video I lay out my three favorite ways to play defense in the stock market right now, and the pros and cons of each.

PSX and VLO have more upside potential as energy rallies (Market Video Update)

Energy remains our favorite sector in equities to be allocated at this juncture. And with the price of oil still making higher highs, stocks such as PSX and VLO look to have more upside potential as well.

EXPE and MET in confirmed Bullish Trends (Market Video Update)

There is always a bull market somewhere, regardless of of how choppy and messy the broader market is. EXPE and MET stock are in confirmed bullish trends.

The notable strength of this value stocks ETF (Market Video Update)

Albeit potentially immediate term overbought, value stocks as represented by the VTV etf may have only just begun their relative outperformance versus growth for the intermediate term.

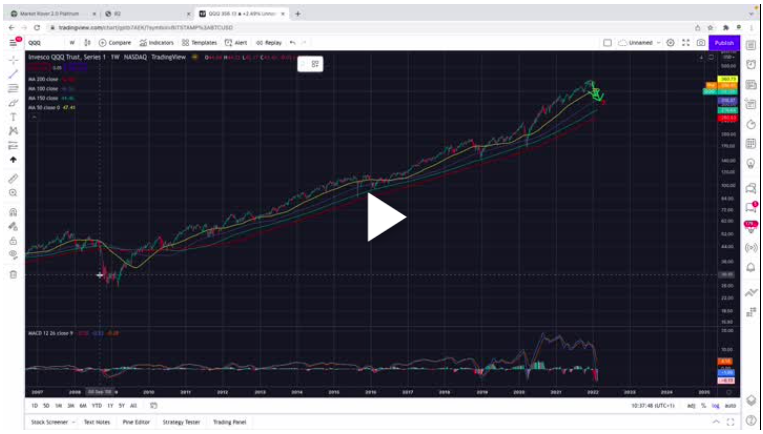

How much more downside in the QQQ? (Market Video Update)

Using a simple moving averages model at this juncture confirms heavy overhead resistance for stocks and indices