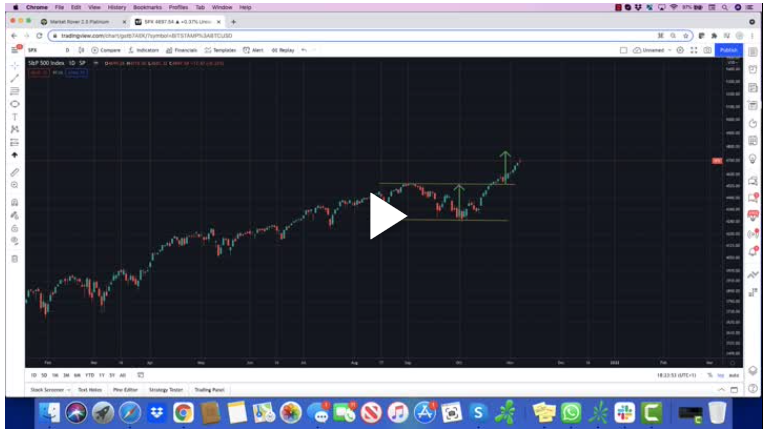

Long the SPY etf (Market Video Update)

In our view, last Friday’s stock market massacre changed little to none of the driving forces of the q4 rally such as fund manager performance anxiety and stock buyback programs. While more near-term volatility is certainly likely, we are liking the SPY here on the long side for a swing trade.

UPS stock could bring some holiday cheer (Market Video Update)

After a long sideways trot shares of UPS may be coiling up for a holiday-season-inspired move higher.

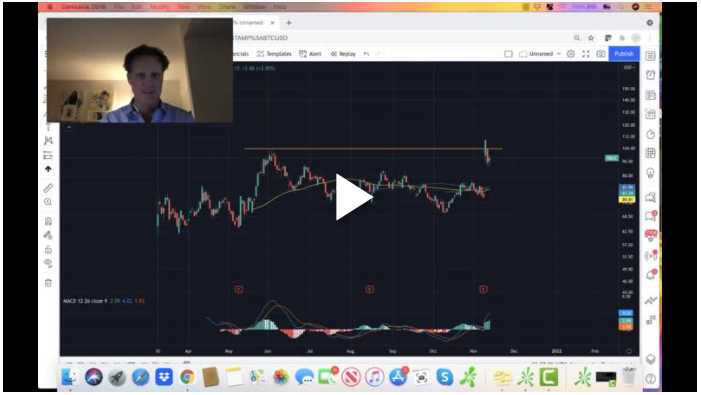

The pullback in BTU we are looking to buy (Video Market Update)

After a hefty correction in Peabody Energy Corp (BTU), our Market Rover still has the stock bullish trend. Our analysis currently reveals that we are one cold snap away from BTU to rally again.

Tech stocks for the remainder of 2021 (Video Market Update)

With only 1.5 months left on the clock for 2021 we want to respect the trend in stocks that have worked higher in an orderly fashion. One group of stocks that falls into this category is the software space as represented by the IGV etf.

This stock could be about to break out of a multi-year base (Market Video Update)

Shares of International Flavors & Fragrance (IFF) could be about to break out higher from a multi-year consolidation phase…thus continuing it’s long term upside trajectory

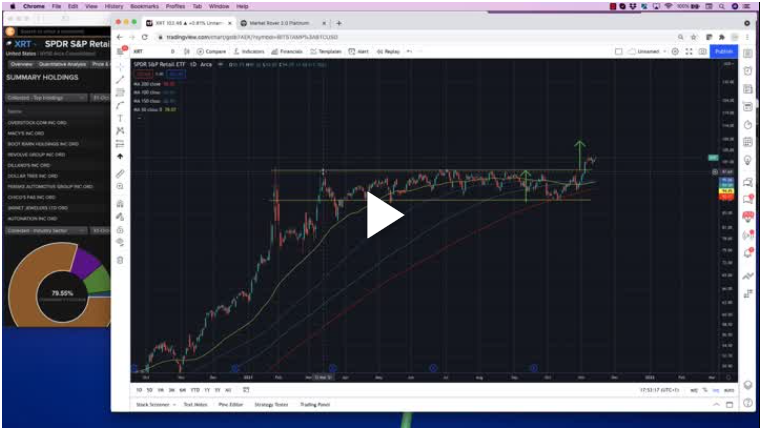

We are watching this group of stocks this week (Market Video Update)

Retailer stocks are on deck this week for important earnings reports. As an industry group these stocks are holding up well and we like to be long them via the XRT etf

My favorite metaverse stock right now (Market Video Update)

By now you’re probably heard of it…right? The Metaverse? It’s an exciting and still somewhat mystical opportunity. But companies that are knee-deep exposed to the metaverse already exist and my currently favorite stock in this space is making some big strides.

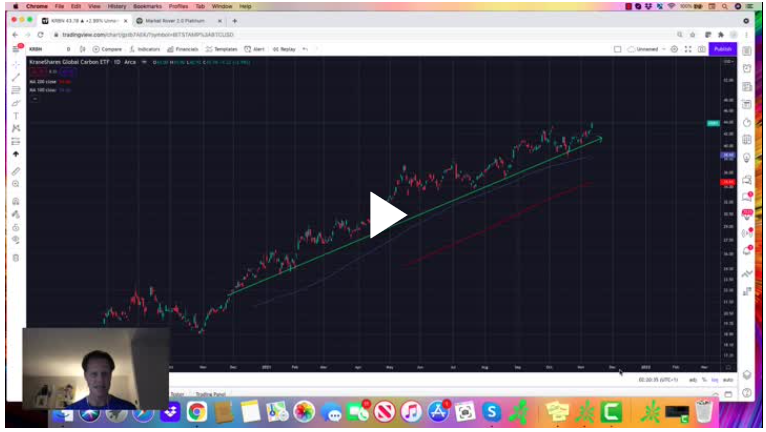

KRBN is a strong trend following story (Video Market Update)

A strong trend that is also in line with the net zero carbon emissions initiatives is the pricing of carbon emissions. The etf with ticker symbol KRBN is one way to ride that bullish secular trend.

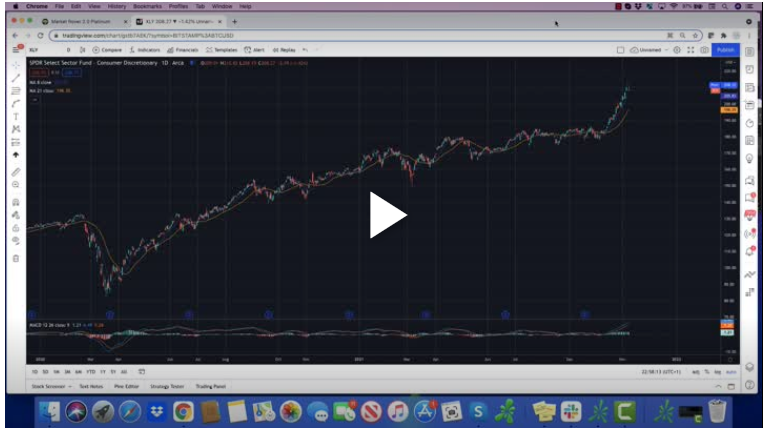

Consumer discretionary and semis short term overbought (Market Video Update)

We have been about as constructive/bullish on many parts equities here in Q4 2021 as we could be…and we remain bullish for now. However, parts of the market, notably consumer discretionary stocks (XLY) and semiconductors (SMH) are getting short term overbought…and not something we want to chase higher here for now.

How to determine profit targets for your trades (Market Video Update)

I get this question all the time; ‘How do I know when it’s time to take profits on my trades?’ In this quick video I show you my two favorite ways to determine profit targets.