Do THIS for successful chart breakouts (Video Market Update)

Chart breakouts in trading and investing are a daily occurrence. Keeping within your time frame of the chart breakout is of crucial importance to do this strategy profitable.

Insurance stocks on breakout alert (Market Video Update)

Insurance stocks such as AFL and the IAK etf have been on a well defined consolidation phase for much of this year. Now they could look to break out higher with a still favorable economic backdrop for them.

Buy signal in FAST (Market Video Update)

Our trend following algorithm is flashing a new trading buy signal in FAST. The stock could stand to further benefit from an infrastructure bill, among other things.

Booking profits on AAPL

Since our July 2nd 2021 call to buy AAPL stock from a tactical perspective and largely based on the broader macro environment, our profit target #1 has been reached and surpassed. We want to take profits here from a ‘trading’ perspective as we head into September.

Does it make sense to use moving averages?

For many self-directed traders/investors, the moving average is one of the first tools they learn about. But does it actually make sense to use moving averages? It all depends on HOW you use them.

Is the next leg higher underway for this new major asset class?

With equities and bonds still pausing after a big run in the first couple of quarters of 2021, the shiny new asset class everyone has been talking about may already be embarking on its next leg higher.

One long and one short for August and September

https://youtu.be/e5pi9_N3mBo As we have morphed from a high growth and inflation economic environment in Q1 and Q2 into one with still good but somewhat less growth yet still sticky inflation, we are making proper adjustments on the tactical side of the portfolios. In general we want to move to more quality and large market cap on the equities side. […]

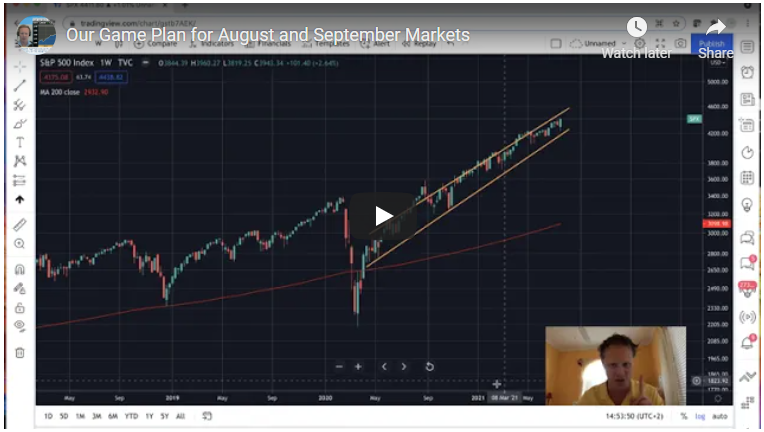

Our Game Plan for August and September Markets

https://youtu.be/xM3fjFizO7k As we slowly but surely start heading toward the tail end of the summer months, a trading game plan respecting history and volatility is to be mapped out. Here is ours.

Equities could remain choppy for a while longer

https://youtu.be/sA4f3AekOlU The ongoing and rolling corrective/digestion period that equities and other asset classes have experienced over the past two months could last another while longer. One can still make money in this type of market however by respecting the trading ranges.

Will stock market volatility soon return?

https://youtu.be/5RYgeDfBUPk Bond yields are largely in charge of what equity markets can and cannot do here in the near term. This, coupled with a crucial indicator to watch can give us clues as to when an uptick in market volatility may be coming.