If you’re not paying close attention to the markets, you’re missing some major shifts happening.

And it could cost you big time in the fall/winter months.

So let’s step back and take a look.

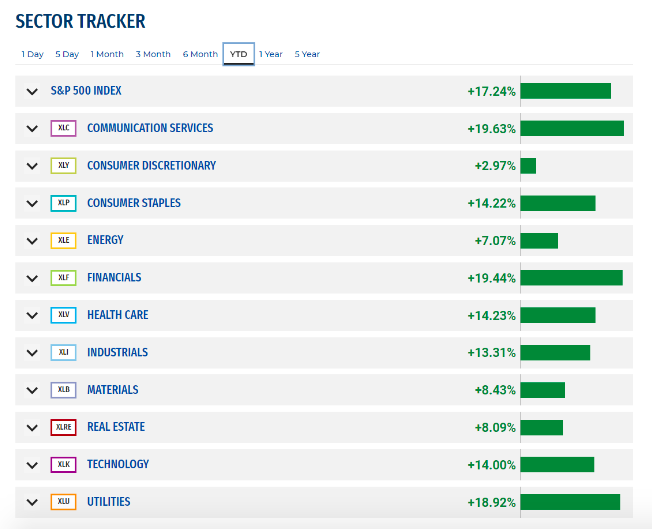

As we begin to close out the month of August, let’s pause to take a look at the S&P 500 (SPX) Year-to-Date and Sector performances.

While large cap growth/technology names were strong early in the year, many will be shocked to find that the Technology Sector hasn’t even cracked the Top 5 performing sectors year to date:

In order of best performance YTD, including the S&P 500 Index:

- Communication Services (19.63%)

- Financials (19.44%)

- Utilities (18.92%)

- SPX (17.24%)

- Healthcare (14.23%)

- Consumer Staples (14.22%)

- Technology (14.00%)

- Industrials (13.31%)

- Materials (8.43%)

- Real Estate (8.09%)

- Energy (7.07%)

- Consumer Discretionary (2.97%)

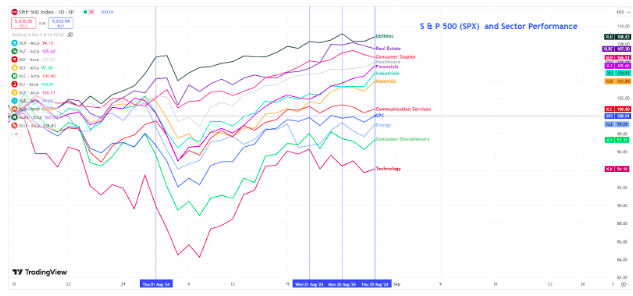

For the month of August, we can look to see what sectors have been outperforming to determine where we want to concentrate our trading/investment efforts going into September and Q4:

August Monthly Performance through 8/29/24 Intra-Day:

Over the last month, we can see traditional defensive sectors of the market outperforming: Utilities, Real Estate, Healthcare and Consumer Staples.

Around mid to late August, there were some outflows in the Technology sector.

As a matter of fact, in the chart below, we can see one of the more “risk on” areas of the market, Semiconductors, weakening vs the Nasdaq (QQQ) around this timeframe:

NVDA – Relative Comparisons

Furthermore, looking more specifically at the semiconductor leader NVDA and in a relative comparison on the chart vs. the (1) Nasdaq, (2) S&P 500, (3) Dow Jones Industrials, and (4) the Nasdaq Large Cap Computer Hardware Index:

NVDA started weakening against ALL 4 of these indexes above around the mid-late August timeframe.

On the other hand, NVDA was exuberantly being purchased prior to earnings (released 8/28/24 after market close) and getting stronger vs Semiconductors.

Only after earnings did NVDA then begin to weaken vs Semiconductors and then fall in line, losing shorter term relative strength vs. the other indexes as well.

Now getting back to the August sector performances above, as of intraday 8/29/24, we can see strength continuing in Healthcare, Financials, Industrials, and Materials, while Utilities also remains strong.

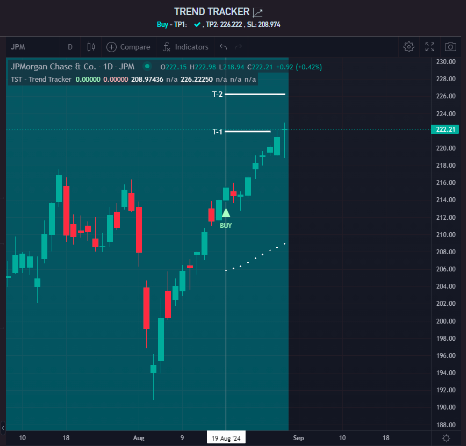

These are a few sectors (and names within) at the current time where we want to continue to focus on moving forward, looking for specific trend/trade set up opportunities and utilizing our proprietary Market Rover and TST Trender algorithm tools.

As you can see, Market Rover is an invaluable tool in our trading toolbox, especially this time of year.

…and we have a special announcement.

As you read this, we’re offering a massive discount on our Inner Circle, so you can get Market Rover in your hands immediately.

Even better, we’re letting YOU pick your bonus – another trading indicator that you can combine with Rover for even more trade ideas.

It’s only good through Labor Day, so you’d better grab it now while you still can!

Happy Trading!